Background

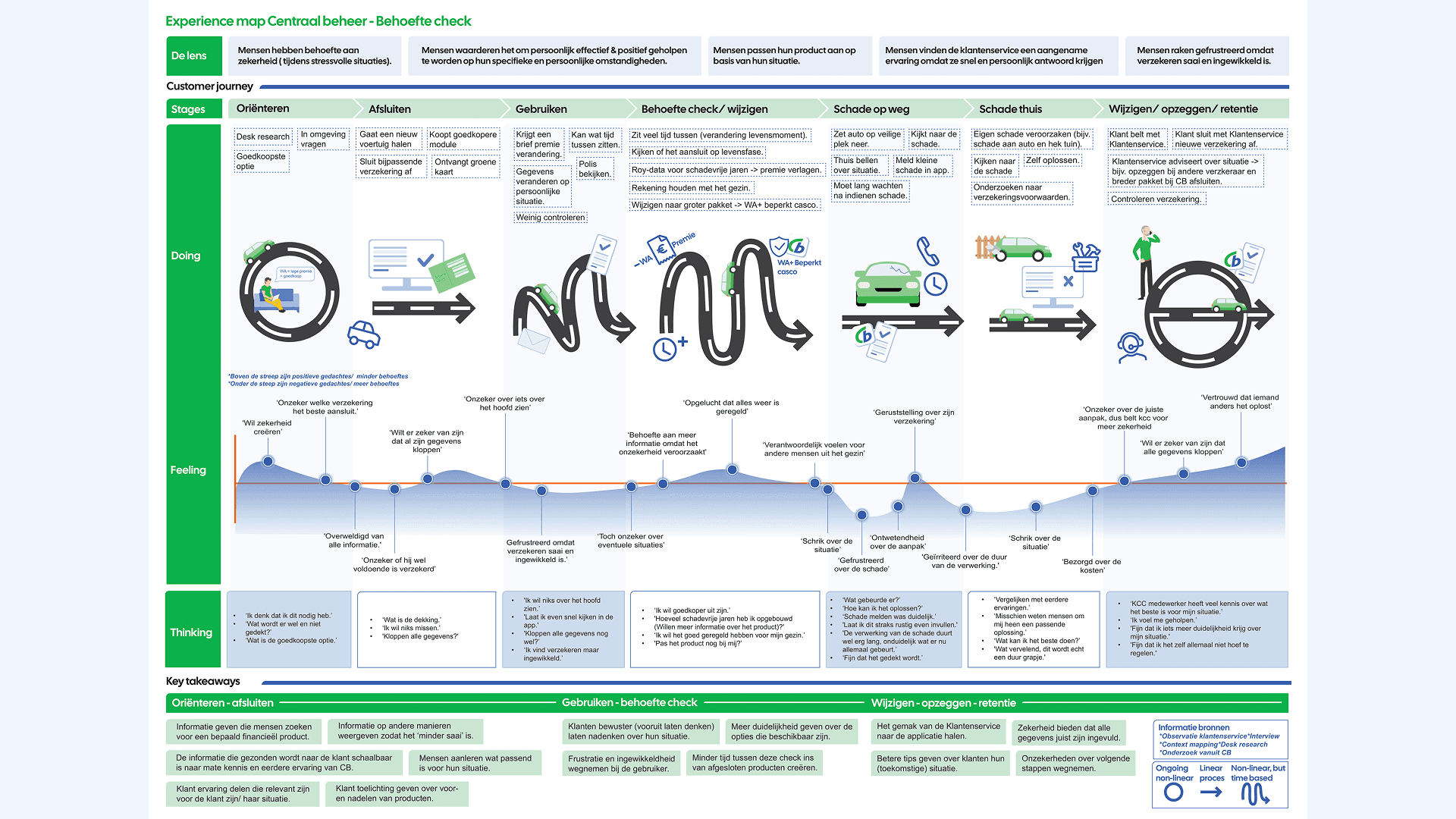

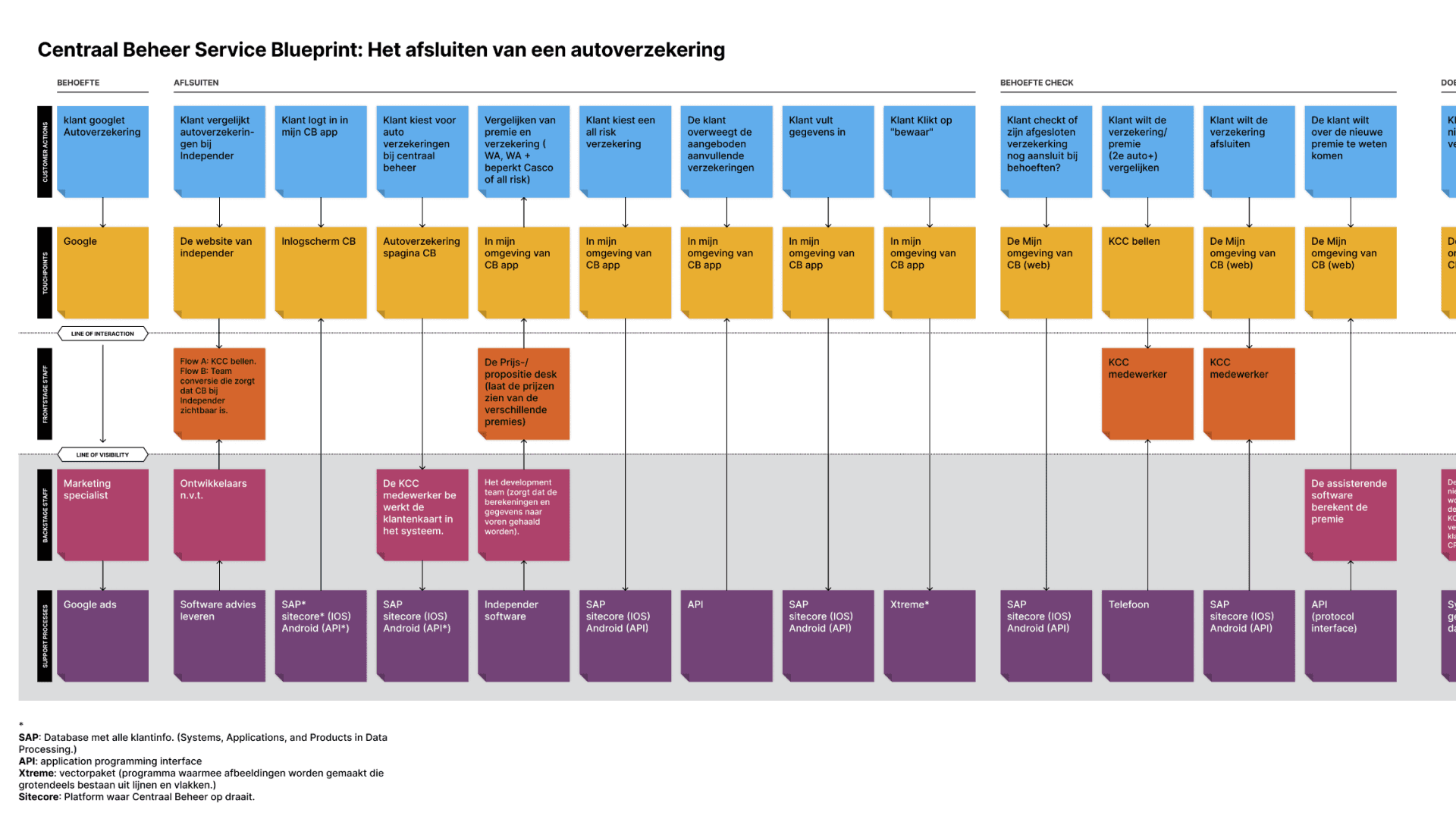

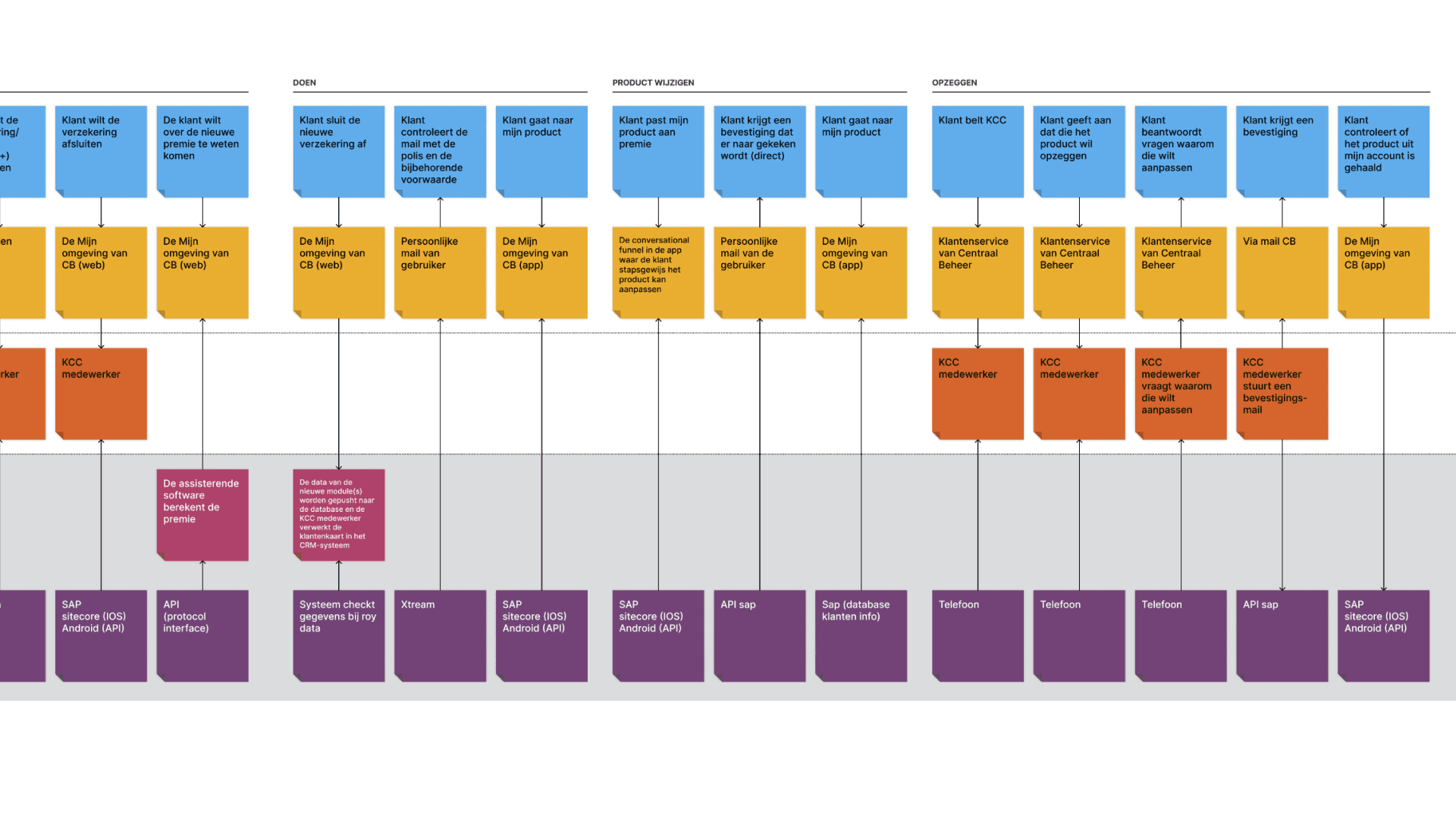

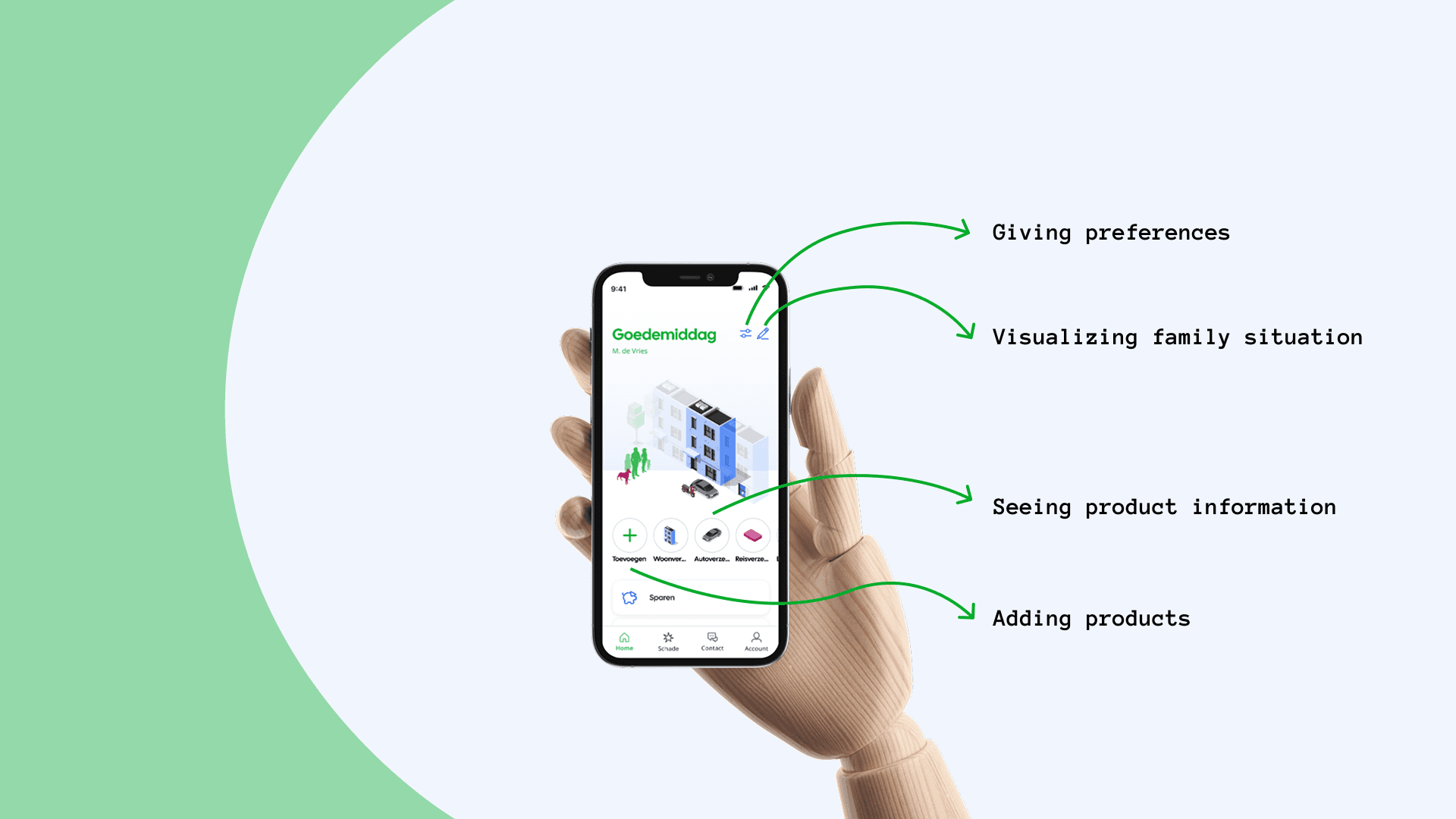

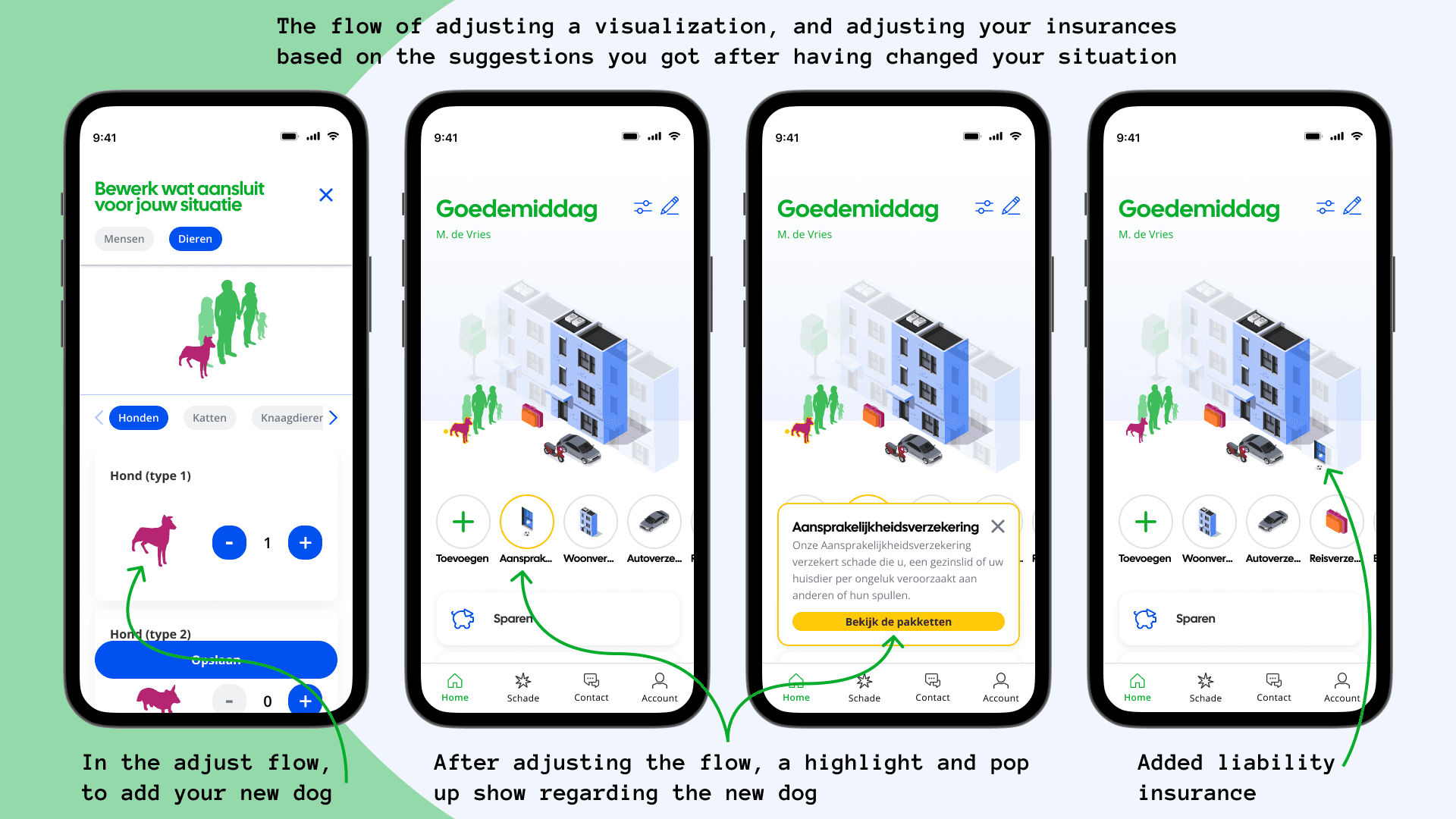

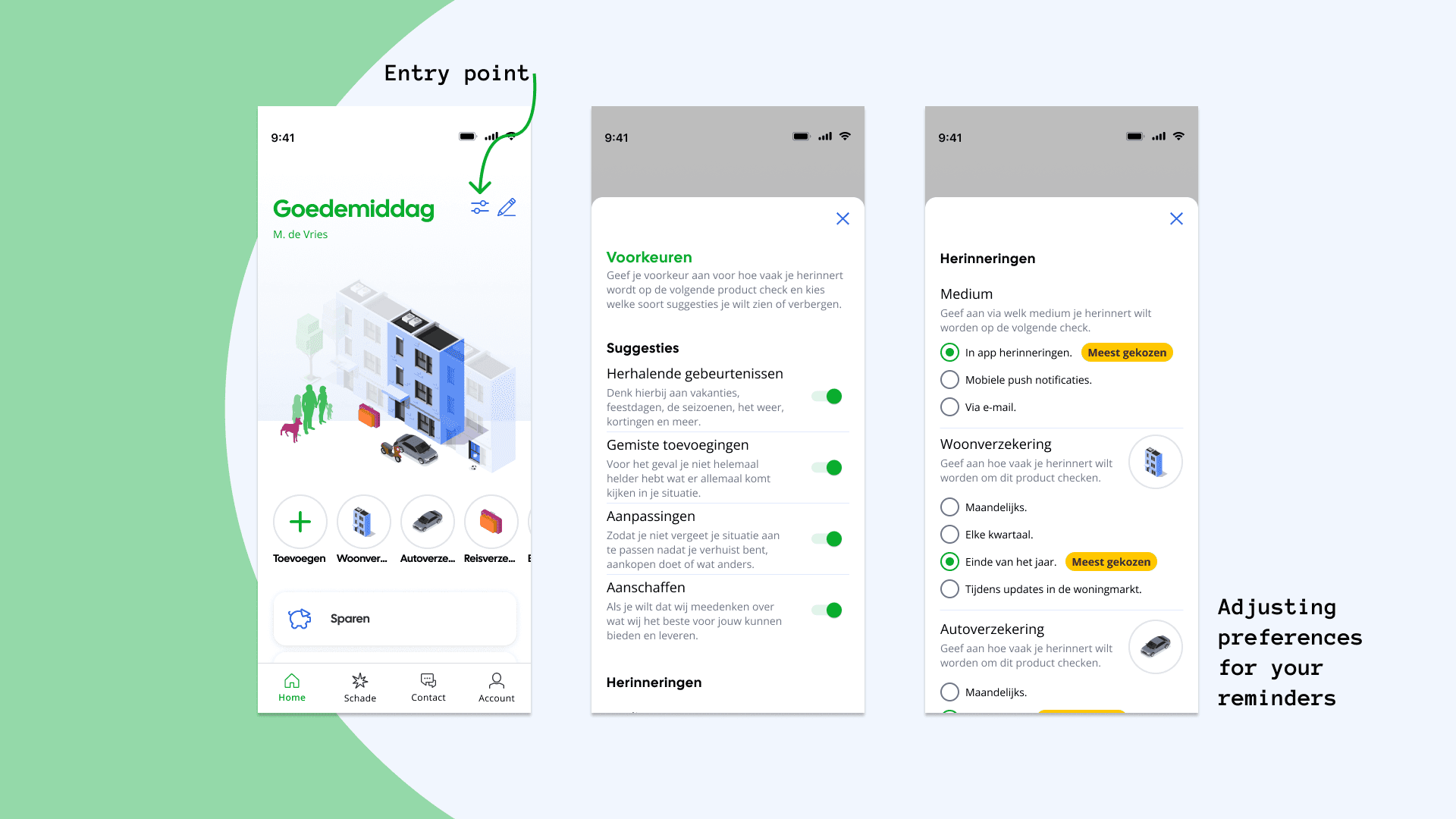

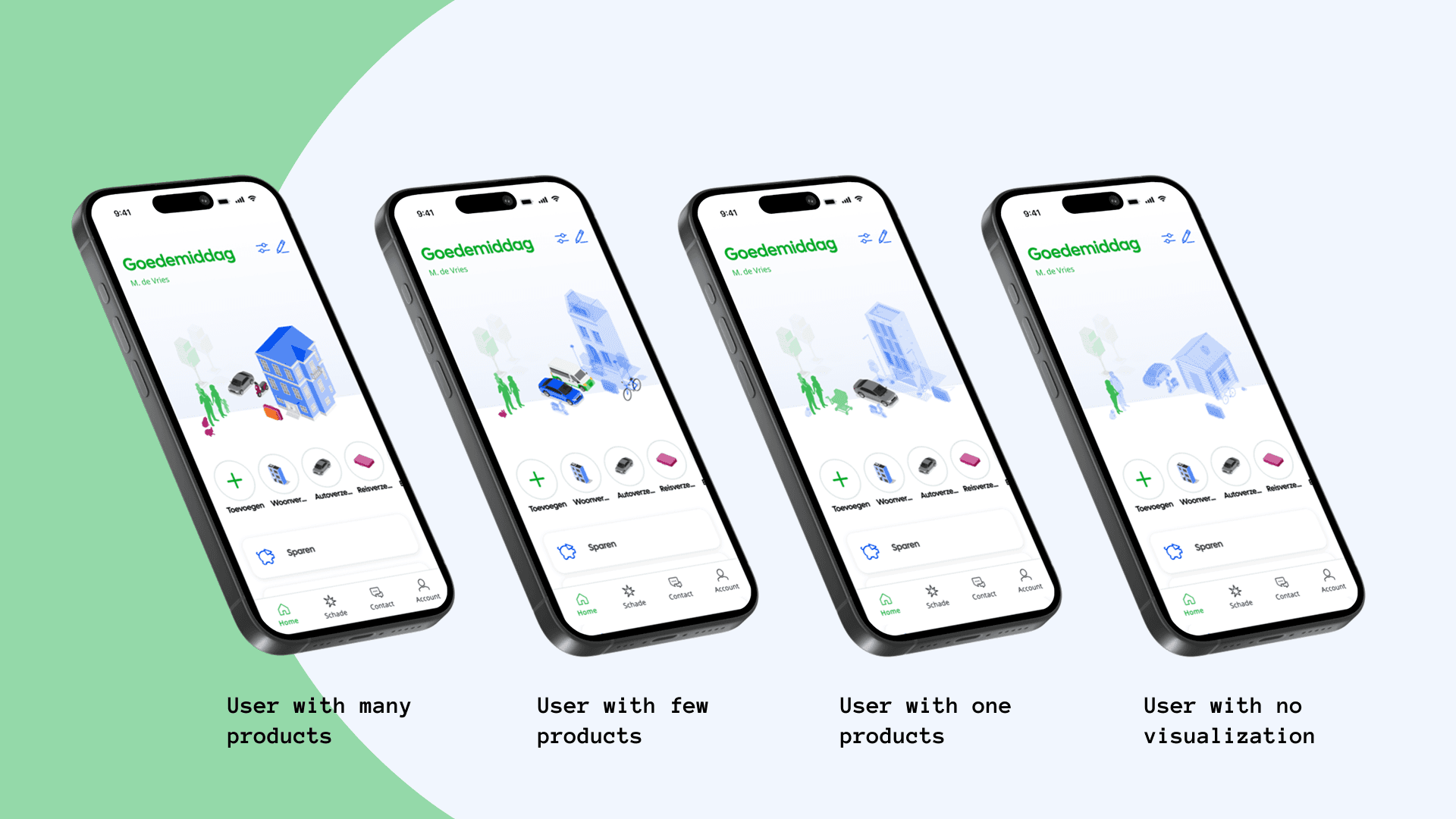

Centraal Beheer (the insurance company, and part of the Achmea conglomerate) came with the question of "how can we better support our users in periodically checking their products?". The team of: Stijn Koller, Cas Verploegen, Jill Hogenkamp, Lise Jeurissen, Max Schrijver, and myself had banded together to create the Situation Mirror/Situatie Spiegel. A way for users to get a clear overview, as well as better understand their financial and home situation. My role was doing end-to-end research, where I took the initative to faciliate key moments such as service blueprinting. As well as being the lead UX Designer in making sure the prototyping of the Situation Mirror worked properly, and was responsive.